The unexpected surge in US power demand, which has caught utilities and regulators off-guard, is putting US emissions reduction targets at risk and putting a spotlight on hydrogen’s role as a key zero-emission energy source once again.

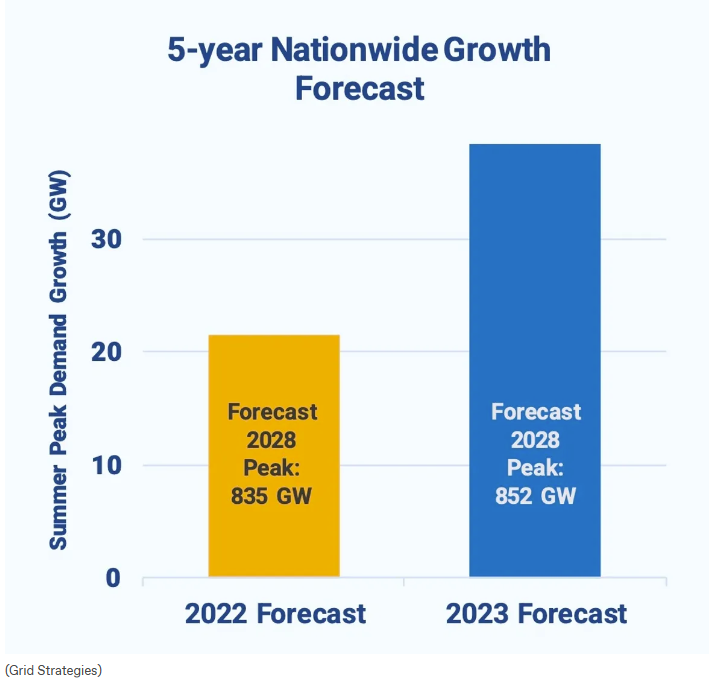

The projected US electricity demand jumped 81% for the next five years, from a 2022 estimate of 2.2% growth to 4.1% growth estimated by utilities in 2023. New industries like data center development for artificial intelligence and distributed computing are straining grids that are also trying to deal with rising loads coming from the reshoring of manufacturing, the electrification of home heating, and new electric vehicle infrastructure.

Decarbonizing power grids in the US requires a massive buildout in transmission infrastructure, energy storage capacity, and renewables that neither manufacturers, project developers, or operators can currently meet.

Decarbonizing power grids in the US requires a massive buildout in transmission infrastructure, energy storage capacity, and renewables that neither manufacturers, project developers, or operators can currently meet.

The number of renewable projects waiting to connect to the grid continues to rise, new energy storage technologies (which are vital) are only just now beginning to reach commercial scale production at their first factories, and finding financing to deploy these technologies will remain difficult until pilot deployments are proven and repeated.

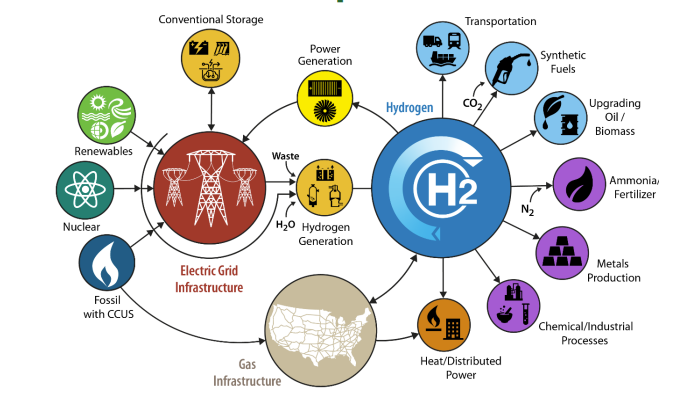

For utilities and manufacturers the only viable near-term choices may be natural gas (as a precursor to hydrogen) and turbines that can eventually use hydrogen fuels for stable 24/7 power as production increases.

And scaling hydrogen production, will, itself, require a larger buildout of renewable power capacity.

And scaling hydrogen production, will, itself, require a larger buildout of renewable power capacity.

Growth of the Hydrogen Midstream Market

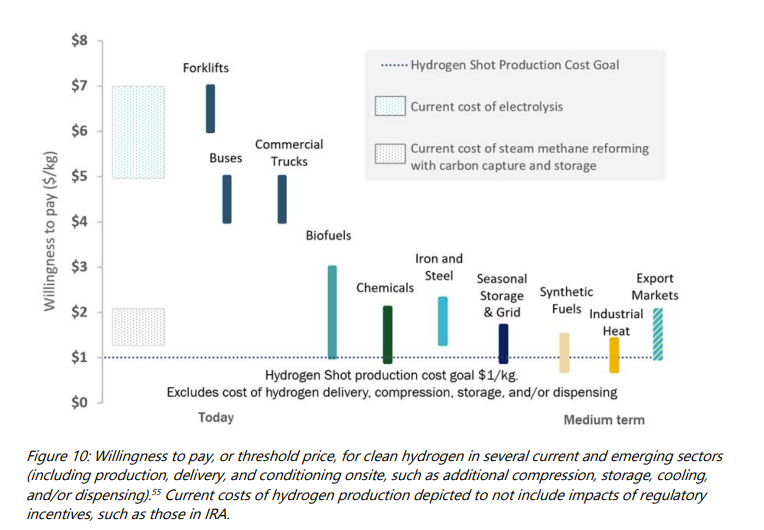

The market is projected to experience significant growth, with particular emphasis on the transportation sector, which could potentially overtake industry as the biggest driver of clean hydrogen demand by 2050. But this shift is contingent on advancements in infrastructure development, technological improvements, and competitive dynamics against other decarbonization technologies – and in the near-term the industrial market will be worth billions of dollars.

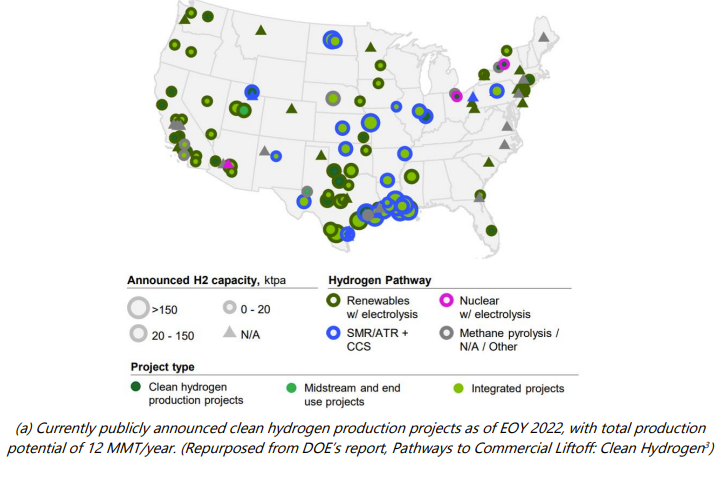

To catalyze this transition, the Biden-Harris Administration has announced the creation of seven regional clean hydrogen hubs across the nation. These hubs aim to foster the production, storage, and usage of clean hydrogen, leveraging various resources and technologies, from renewable and nuclear electricity to natural gas with carbon capture. Each hub is designed to target specific regional advantages and applications, including decarbonizing public transportation, heavy-duty trucking, port operations, and industrial sectors like steel and glass production. Notable examples include the Mid-Atlantic, Appalachian, California, Gulf Coast, Heartland, and Midwest hydrogen hubs, each receiving substantial federal funding up to $1.2 billion.

Image Credit: Department of Energy

The Department of Energy’s (DOE) strategy involves extensive research, development, and demonstration projects to reduce costs and improve hydrogen technologies. Key milestones in 2023 included the selection of Regional Clean Hydrogen Hubs for up to $7 billion in funding and launching a $750 million funding opportunity for electrolyzer R&D. These initiatives are part of the U.S.’s efforts to lead in clean hydrogen technologies, aiming to unlock private investments and create thousands of jobs across the country.

Demand formation and incentives are crucial to the growth of the hydrogen market. Governments worldwide are providing funding and incentives to stimulate the demand for clean hydrogen. The U.S. and Europe lead with public funding exceeding $300 billion. To achieve the targets for hydrogen demand, incentives for users, alongside producers, are deemed necessary.

The global hydrogen storage tanks and transportation market is also on the rise, with major vendors across various regions contributing to the infrastructure necessary for a hydrogen-based economy. Companies like BayoTech in the US, Hexagon Purus in Norway, and Doosan Mobility Innovation in South Korea are key players in this market, showcasing the international effort towards adopting hydrogen energy. This market’s growth is propelled by the increasing adoption of fuel cell vehicles, concerns about air quality, and the rising demand for off-grid power solutions.

Hydrogen Demand By Sector

By 2030, the global hydrogen market is anticipated to undergo significant expansion and diversification across various sectors. Key insights from the sources indicate several major markets for hydrogen use, driven by both regional growth and application-specific demand:

- Industrial and Chemical Sector: Currently, the largest market for hydrogen is in industrial applications, particularly in ammonia production, which accounted for the largest revenue share in 2023. This sector is expected to maintain its lead due to ammonia’s potential as a carbon-free fuel and hydrogen carrier. Methanol production is also highlighted as a significant application, with hydrogen acting as a key component in reducing CO2 emissions in the atmosphere.

- Energy and Power Generation: Hydrogen-based power generation technology has established itself in mature markets like North America and Europe. This market is expected to see optimistic demand due to its cost-effectiveness and reliability as a source of clean energy.

- Refineries: Hydrogen is extensively used in refineries for hydrotreatment and hydrocracking processes. These processes, which are critical for producing transport fuels and petrochemical feedstock, represent one of the major applications of hydrogen, highlighting the sector’s significance in the hydrogen market.

- Transportation: While not the largest market as of the latest data, the transportation sector, particularly for short distances, is expected to be the fastest-growing segment. Investments in advancing hydrogen technologies to meet the demand used in consumer automotive are expected to drive this growth.

Image Credit: Department of Energy

For the world to achieve net-zero carbon emissions goals by 2030, global demand for hydrogen needs to more than double from its 2020 level to 212 million metric tons (mt). This increase is crucial for transitioning existing uses of fossil energy to low-carbon hydrogen, including industrial uses, refineries, power plants, and blending hydrogen into natural gas networks.