A new potential source for emission-free hydrogen is currently having a moment.

Last month, the startup company Koloma raised roughly $246 million dollars from a host of investors to continue the development of its exploration and development services for hydrogen found in underground deposits.

The company is one of a host of businesses around the world looking for opportunities to develop geologic, or “white”, hydrogen as an alternative to conventional modes of hydrogen production – seen as critical for the energy transition.

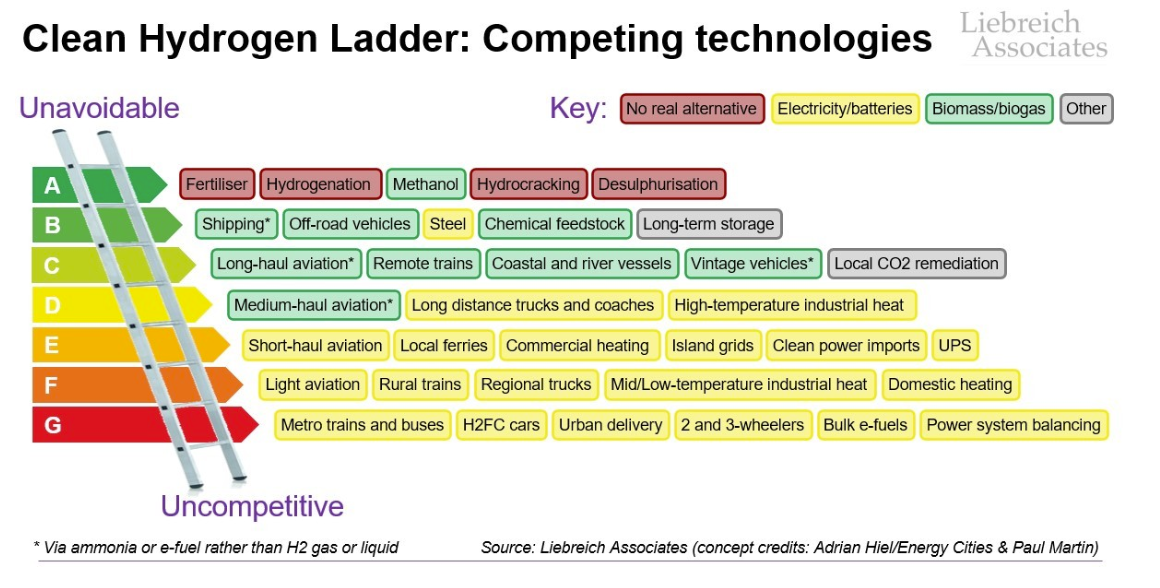

As a fuel, hydrogen does not emit any greenhouse gasses when burned and it’s seen as an ideal solution to both store and produce energy. It’s also a critical feedstock for the chemical industry and the main ingredient in ammonia production – itself vital to the agricultural industry as fertilizer.

Huge industries already depend on it, and as an energy source it could replace fossil fuels in a number of applications.

Image Credit: Liebrich Associates

According to the International Energy Agency, hydrogen use extends to several parts of the energy sector and the global energy monitor expects production to increase sixfold from today’s levels to meet 10% of total final energy consumption by 2050.

Historically, hydrogen was produced from coal or natural gas, but as concerns over fossil fuel emissions mount, renewable energy is being used to power processes that convert water into hydrogen using electricity from solar and wind. This “green” hydrogen production system is emerging as the alternative to “gray” hydrogen produced from natural gas directly, or “blue” hydrogen that relies on carbon capture systems to reduce emissions from the methane-to-hydrogen conversion process.

Now, companies like Koloma are pursuing the development of “white” hydrogen that taps into underground hydrogen resources, which could reach as much as trillions of tons of the fuel.

“Historically, geologic hydrogen was overlooked,” Geoffrey Ellis, Research Geologist at the US Geological Survey told S&P Global in an interview. “Now it is clear…that anybody that is doing any kind of drilling and is producing gas is looking for hydrogen – they see hydrogen as a potential resource.”.

New Discoveries

So far, the only white hydrogen well that’s producing energy is located in Mali. In 1987, a water borehole drilled near a small village hit gas and exploded. Developers discovered that the gas deposit was 98% hydrogen and in 2011 the company now known as Hydroma began producing energy from the hydrogen well to provide energy to a local village.

Over the last several months, discoveries of hydrogen deposits in Albania and France have led geologists to speculate that vast resources of hydrogen could be accessed using conventional oil and gas technologies and at costs amounting to a fraction of current low-carbon production techniques. French researchers estimate their discoveries could yield as much as 3 million tons of hydrogen per year. While that won’t meet current global demand, which sits at 100 million tons, it’s a sizable discovery for the country.

And geologists estimate that other untapped deposits could lie in the US, Australia, and other European countries including Spain, Germany, Kosovo, Iceland, Finland, Sweden, Poland, Serbia, Norway, and Ukraine.

How Much Is There?

According to Ellis, early calculations suggest that there might be around 10 trillion tons of natural, or “geologic” hydrogen buried underground worldwide. While many of these reserves may be too deep or remote to tap easily, even a small fraction could potentially meet the world’s energy needs for centuries.

The US Department of Energy’s Advanced Research Projects Agency-Energy (DOE’s ARPA-E) indicates that natural hydrogen could be extracted for less than $1,000 per ton, making it substantially cheaper than manufactured hydrogen. Moreover, the Earth may generate hundreds of millions of tons of new natural hydrogen annually, suggesting a potentially renewable resource.

However, the actual exploitation of geologic hydrogen faces several challenges, including the need for further data to pinpoint where the main reserves are and where the most active generation is taking place. The USGS is developing new modeling tools aimed at addressing these gaps, focusing on areas where hydrogen could accumulate and be economically recoverable.

S&P Global highlights the growing interest in geologic hydrogen as a decarbonization fuel, noting that millions of dollars have been invested in exploration with the aim of monetizing its potential. While the resource offers promising prospects as a low-carbon fuel, significant hurdles remain before it can be widely used. Global demand for hydrogen is projected to rise significantly, and geologic hydrogen could play a role in meeting this demand, especially if a small fraction of the estimated reserves can be accessed economically.

New Companies Are Racing to Drill Down

Several startups are racing to tap the market for this new energy resource.

Among them, notable startups include:

-

-

-

-

- Natural Hydrogen Energy (NH2E), founded by Viacheslav Zgonnik, focuses on exploring natural hydrogen with plans for new wells in the United States. The startup aims to tap into the renewable source of clean energy continuously generated in the Earth through natural, inexhaustible processes.

- Koloma is another startup that has garnered attention and investment backing from entities including Breakthrough Energy Ventures, founded by Bill Gates. Koloma has been actively involved in the exploration and potential exploitation of sustainable and exploitable white hydrogen deposits.

- Helios Aragon, established in 2018, owns gas exploration permits in the north of Spain and is developing Europe’s first natural hydrogen production project with plans to begin drilling the Monzon-2 appraisal well.

- Hydroma, previously known as Petroma, shifted its focus to hydrogen exploration after discovering pure hydrogen in Mali. The company has drilled multiple wells and discovered several accumulations of natural hydrogen.

- Eden GeoPower, a platform technology developer for geological energy exploration and development, is working with researchers on a stimulated geologic hydrogen project funded in part by the Department of Energy.

-

-

-

Tapping the Market

Image Credit: S&P Global

Energy analysts expect the market for hydrogen to explode. Current demand sits at roughly 97 million mt/year, which is primarily used in industrial sectors like oil and gas, chemicals, and agriculture. Within the next decade, as more hydrogen is used for fuel and energy, those numbers are expected to rise to 119 million mt/year in 2030 and 265 million mt/year in 2050, according to S&P Global data.

To meet this demand with current low-carbon hydrogen production technologies, the International Energy Agency expects governments to spend over $1 trillion to drive down costs. Countries that have already adopted hydrogen strategies have committed at least $37 billion; and the private sector has announced an additional investment of $300 billion. But putting the hydrogen sector on track for net zero emissions by 2050 requires $1.2 trillion of investment in low-carbon hydrogen supply and use through 2030, according to the IEA.

Early Days

One entrepreneur working in the industry said it would be unlikely to see any commercial development until 2029 at the earliest. The public discoveries announced to date are not economical to develop, and projections about viable reservoirs are only projections. There are no companies with a well-developed framework for the best geologies to develop and how much those geologies will produce. Either the discovery of a productive reservoir in the millions of tons or the development of catalysts that can stimulate production would be the true starting gun for commercialization.