We took some time yesterday to read through the executive order that the Biden administration issued yesterday. Naturally, it has a lofty title, “Executive Order on Tackling the Climate Crisis at Home and Abroad”. Naturally, this being Biden’s second week in the White House, it doesn’t have many specifics on renewable energy policy. It’s mostly concerned about winding up the bureaucratic machinery to pursue climate goals. Regardless, everyone in the industry is psyched, us included. But we’re also apprehensive of how renewable energy economics, and particularly solar economics will change. In the absence of specifics applicable to renewable projects, we can look at Biden’s general tax plan. One feature of the tax plan is, of course, an increase of the corporate tax rate to 28%. Another feature is the introduction of a minimum 15% tax on book income for corporations with at least $100 million of book income.

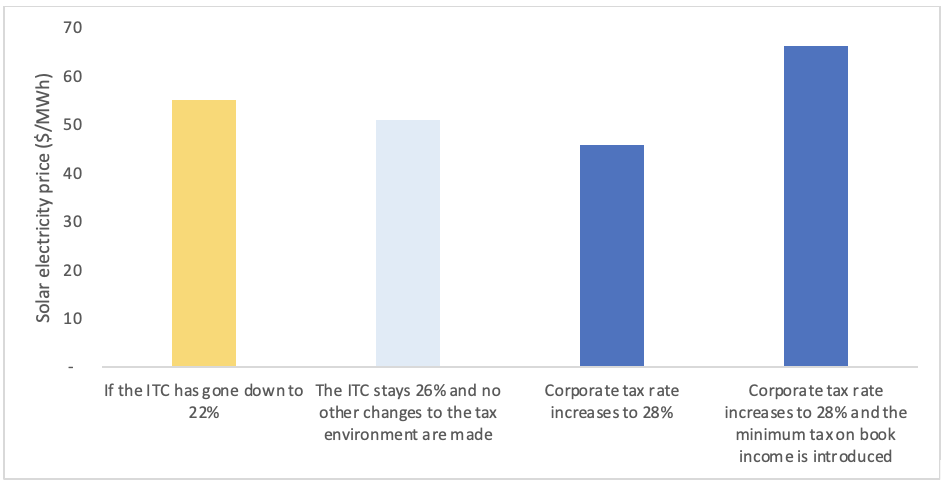

How are these changes going to affect solar projects? To answer that question, we considered the development of a hypothetical large utility scale solar project put in service at the end of 2021 with a 20 year PPA. We calculated how the project’s owner would need to price the PPA, in cents/kWh, to achieve a levered return on investment of 15%, under different tax scenarios. Most of our assumptions are derived from NREL’s solar costs benchmark.

ITC increase. For good measure, we included a scenario where the ITC had dropped to 22%. Thankfully, the ITC will remain at 26% until 2024, thanks to the extension bill that Congress enacted last December. On a 100 MW project costing $106 million, the difference translates into $4 million back into the pockets of the investors, or $4/MWh into the pockets of the offtaker.

Corporate tax rate increase. Counterintuitively, increasing the corporate tax rate can increase returns on solar projects, and therefore lower the price of solar electricity. This is the case when bonus depreciation or MACRS depreciation create big tax benefits in the early years of a project. The higher the tax rate, the bigger the benefits.

Minimum tax on book income. This is going to be a bummer. In many case, the minimum tax will have the potential to negate much of the aforementioned depreciation benefits in many cases. Investors take an ownership stake in solar projects because the early depreciation that solar projects experience under the tax code helps them offset taxable income and therefore pay less taxes. (The mechanism applies to all kinds of assets. Jared Kushner used it to avoid paying taxes for years). The minimum tax rule creates a hard limit on how far corporations can take this benefit. When that limit is hit, owners will pay 15% of their book income in taxes. Book income is typically based on the linear depreciation of the solar asset over its useful life, as opposed to the fast bonus or MACRS depreciation that tax income is based on. As a result, in the early years of a solar project, tax income is (very) negative, while book income is (normally) positive. So, for those corporations subject to the minimum tax, having a solar project on the books becomes a tax liability as opposed to a tax benefit.

It looks like overall, the effect of Biden’s tax plan is that, fewer investors will be lining up to fund solar projects, and overall, those investors will have less appetite for tax benefits. In that event, the corporate tax rate increase will be far less palatable. If the new administration is serious about its clean energy policy, this would be a good time to talk about exemptions from the minimum tax.