The idea of an energy transition to a decarbonized world has ignited a philosophical battle between those who believe it is an inevitable and necessary step in the progression of the human species and our future on this planet and those who think it is a mythic concept akin to faster than light travel.

At the center of this debate lies perhaps the most important component of any energy economy: the ability to transport and store energy in a form whereby it can supplant natural gas, gasoline, and other traditional fuel sources, not just in terms of how it can be leveraged, but also with no carbon emissions at the point of use. The answer to this quandary is green hydrogen.

On one side of the debate are the visionaries heading up some of the largest companies in the world; on the other, those who view the extent and scope of the change to be so immense as to be unrealistic. Unfortunately, neither side seems to be publicly willing to acknowledge the complexity of the challenge – but there is far more to it than fact or fiction or hydrogen or hopium – the transition is inevitable and necessary, and time spent debating the if and the why, would be far better spent discussing the WHEN and the HOW.

Hopium:

There is, in some sense, an ideological war being waged between those who see the transition to hydrogen as a necessary and inevitable step in the energy transition – and those who view the transition as a threat to the existing hydrocarbon industry and an impossible dream. The term “hopium” has become the catch-all phrase used among those more negative circles to describe a hydrogen-powered future. However, the reality behind this dichotomy is intrinsically and significantly more complicated than either side of the debate seems to be willing to acknowledge openly.

In reality, the science is crystal clear. Increased levels of carbon dioxide entering the atmosphere are having a significant, apparent, and obvious impact on our environment. While some may disagree with this assertion, there is no credible scientific basis for dissension from this fact. Such disagreements tend to be predicated on little more than longing for a magical reality whereby you can flood a limited atmosphere with a foreign chemical at unprecedented volumes and expect nothing to happen. It effectively amounts to putting food coloring in water and then being surprised that the water has changed color.

There is no escape, however, from the human race’s need for energy. The entire world is run by and from energy. Therefore, one cannot simply shut off hydrocarbons and their necessary place in the energy economy (not to mention their role in everything from pharmaceuticals to fertilizers). In fact, there is a credible economic theory that if you boil everything down to its essence, money is no more than a medium of exchange for the energy required to create products and services, as, without energy, there is no production, no products, no services, and no economy.

Soviet astronomer Nikolai Kardashev formulated a theory in 1964 that the only valid methodology for measuring the sophistication and advancement of a hypothetical alien species would be to view its energy consumption. A Kardashev Type I civilization is one that can harvest all the energy delivered to its planet by its host star (in our case, the Sun), and a Type III civilization is able to harvest all of the energy generated by its entire host galaxy (and a Type II falling in the middle). This theory is still used to this day because it is just that difficult to escape the interlinkage between energy availability and exploitation and industrial, scientific, and social advancement. We will as a species never escape our need for energy – all we can hope to do is mitigate our demand for energy in terms of the environmental and societal impacts of extracting it.

Hydrogen vs. The Oil and Gas Industry:

Some of the hydrogen negativity is unquestionably at least in part, driven by the protectionism of a somewhat beleaguered oil and gas sector and the narrative created by industry lobbyists. The sector remains staggered by the impacts of COVID in 2020, with production not even close to the historic highs of 2019. The unconventional oil and gas vertical, normally turning on a near dime from bust to boom, in this cycle is taking an unusually long time to do so. Even with planned drilling and completion activity, ongoing staffing issues plague the market. In 2021 and 2022, employees, exhausted by the recent hydrocarbon price volatility over increasingly short cycles and the resultant never-ending programs of layoffs, have migrated in record numbers (and permanently) to different and more stable industries. This trend shows no sign of slowing, with 14,000 workers leaving the space in January of 2022 alone.

Compounding it all, driven by the bad press (which in some cases was well deserved) around the lack of cash returns and historic investor value destruction in shale exploitation activities (with some even going so far as to call it a Ponzi scheme), is a shortage of investment capital being directed towards the sector as private equity investors continue to shy away from the volatility of unconventional oil and gas in North America, in favor of ESG themed investments (at least on paper).

Capital raised in North America for conventional energy investment being on a downward trend is nothing new. It peaked in 2015 at around $47 billion and began to decline with the downturn in 2016, halving the volumes of raised capital and culminating with less than $10 billion raised in 2021 – a year where in general, the private investment sector raised more money than ever before (just not in conventional energy sectors). So, there is little wonder that some in the industry have reservations about a new emerging energy economy that may displace theirs and potentially their livelihoods.

This, however, is likely a short-sighted view, as there is much more to hydrogen than simply carbon-free energy – and in fact, there are many similarities in the infrastructure required to generate, transport, and store it to natural gas. It is for this reason that it is the oil and gas supermajors that represent the largest investors in renewable and blue hydrogen.

The Hydrogen Transition Represents an Opportunity, Not a Threat:

The struggles faced by the oil and gas industry (albeit not the largest entities in it, which are enjoying huge profitability surges due to high hydrocarbon pricing) notwithstanding, it is likely not appropriate for any employee in the oil and gas industry to see hydrogen as a threat to future opportunities. A book could be written about the transferable skillsets required from the oilfield and other conventional energy industries that are essential to enable the transition to renewable hydrogen.

Any version of a hydrogen economy requires pipelines, energy generation systems, interconnects, substations, and underground storage to regulate the disconnect between the innate seasonal cyclicality of renewable energy generation vs. the seasonal cyclicality of energy demand (renewables are more abundant in the spring and summer than in the winter – the near opposite of the energy demand cycle). Storage of hydrogen above ground requires extensive tank infrastructure and below ground requires cavern mining from salt formations – which encompasses drilling, completions, and pumping, much like hydrocarbon extraction (and storage).

In short, the same infrastructure required for the primarily natural gas-driven conventional energy sector to function is needed for a hydrogen economy. This will resultantly require fundamentally the same workforce, with fundamentally the same skillsets. Additionally, with the rise of ‘blue hydrogen’ (hydrogen generated from natural gas through steam methane reforming processes, with the sequestered carbon), it is also, arguably, necessary for natural gas to form part of the transition. The simple reason is that for renewable hydrogen to truly be cost-effective and make sense, there would have to be enough renewable energy generation to power the entire electrical grid and have ‘spare’ energy for storage and use in hydrogen applications (e.g., fuel cells, combined fuel generators, etc.).

With renewable energy generation only representing 17% of the USA’s total electricity production as of May of 2022, it is likely a thirty-year journey before this becomes even close to reality, leaving absent blue hydrogen, only gray hydrogen (hydrogen generated from non-renewable sources, without mitigation) as a potential platform for point of use hydrogen application development – which is far from desirable.

Until this is the case, conversion to renewable hydrogen, although noble and necessary (one must start generating it somewhere, and as soon as possible), amounts to converting existing electrical energy to hydrogen with at best an 84% efficiency. Blue hydrogen is not immune to this problem either, as it would still be more energy efficient to burn the natural gas and sequester the carbon than to convert it to hydrogen and do likewise. However, this impact on blue hydrogen is, in part, lessened because of the significant existing infrastructure for industrial hydrogen production, which can be converted to the generation of blue hydrogen. Additionally, there are substantial environmental and economic benefits to sequestration of the carbon at the point of production of hydrogen, vs. attempting to sequester carbon at a myriad of natural gas burning turbine locations – which, although possible, does not benefit from the significant economies of scale made possible by centralized sequestration, either through conversion to black carbon or underground storage.

Blue Hydrogen vs. Green Hydrogen – Why do We Need Both and What Is the Difference?

Theoretically, this blue hydrogen can be used as a bridging fuel, providing enough usable hydrogen for end-use applications to be worth developing and investing in. But, as is clear to everyone, there is no point in buying a fuel cell-powered car if there is nowhere to fill it and nothing to fill it with. Similarly, there is no point in building a hydrogen facility if there is no market for the hydrogen itself. This is the chicken and the egg situation at the core of the debate around the potential future of hydrogen.

Blue hydrogen, developed from natural gas, is one possible solution to this quandary. Although not quite ‘Green Hydrogen’ (hydrogen produced only from renewable power), the breadth of what is considered a ‘renewable’ energy source in recent times has expanded sufficiently that there may not be as much of a difference in sustainability as may be supposed. The purpose of what is to follow is not to poke holes in the concept of renewable energy. Rather it is to point out that the issue is complex and that there may not be a perfect solution to our need for energy, which will become important later in the article.

Biomass power plants are roundly considered ‘renewables,’ even though their sustainability when considering the change in land use is sometimes dubious. One needs to look no further than the near total deforestation of Madagascar in favor of palm trees for palm oil production to see the impact that some ‘renewable’ fuels have wrought on the planet. The statistics are, frankly speaking, harrowing. Some estimates indicate that ~2200 animal species are thought to have been driven to extinction in Madagascar alone. All these species were found nowhere else on the planet causing permanent loss of biological diversity on a nearly unprecedented scale, all in the name of ‘sustainability’.

Hydroelectric power is predominantly generated by damming rivers, and this practice can scarcely be described as sustainable. For those doubting this, consider the impact on non-farmed indigenous native salmon throughout much of the Pacific Northwest, where populations have declined more than 85% in the last 20 years because of this practice. This has had the expected knock-on impacts on predator populations who depend on them as a food source. Books written in the 1800s talk of salmon so dense as they migrated upstream to spawn that it seemed as if one could walk on the river’s surface on their backs. This sight is not something that anyone currently living on this planet has seen because we have decimated the salmon population.

This type of difficulty is a complicating factor in the energy transition in general and is overplayed far too often. Decarbonization will unquestionably have a positive environmental impact, NET of the ancillary effects outlined above – even acknowledging the innate difficulty in identifying a source of renewable energy, other than perhaps geothermal, that does not require an enormously extractive and destructive process for it to exist. Solar and wind both require rare earth elements, invariably mined from remote corners of the planet to be constructed, have limited life spans, and the process of mining said rare earth elements is replete with risk to the environment. There is also a finite quantity of those rare earth elements.

While this extraction process is largely outsourced to the developing world, local impacts are seldom experienced in the places benefiting from this renewable energy – the impact on the planet is unquestionable. None of this is to say that more renewables will not significantly reduce the environmental impact of the human species on the planet – in terms of harm caused and harm reduction, but rather to say that the difference between green and blue hydrogen, although real, is not absolute. The current mechanisms to deliver these goods to their intended users are traditional sea, rail, and air transportation – the remit of diesel and other conventional fuel sources.

Regardless of one’s opinions on blue hydrogen being part of the overall renewable hydrogen narrative vs. green hydrogen – it is part of the narrative, with Chevron announcing a $2.5 billion investment in Blue hydrogen over the next five years and many others following suit. This, combined with a large swathe of green hydrogen investments, will lead to a situation whereby hydrogen production doubles from less than 100Mt per year today to 253Mt per year in 2050, which is forecast to track demand.

It is anticipated that renewable ammonia will be the main beneficiary of this hydrogen production through 2036 before energy production begins to take over as the primary use case for hydrogen. This growth calls for $600 billion in near-term investment to realize. But, this is also where the rub lies. Even with this growth, and the 8,448 terawatts of energy that it represents, it is anticipated that only 44% of global energy production will originate from renewable sources by 2050 and that 44% of the demand will still be serviced by hydrocarbon-based energy generation approaches.

The Energy Transition is a Generational Ambition:

The energy transition is a generational ambition that will span the next 50 years as it comes to fruition. Much of the negativity around the viability of hydrogen, stems from the seemingly insurmountable nature of the change and the nearly unimaginable (in practical single lifespan terms) timelines for that change to take place. Children just entering primary school this coming fall will likely be middle-aged or older prior to hydrogen becoming as available as gasoline, and many would regard that as an optimistic timeline. However, the length of that timeline and the generational nature of the change do not make that change any less necessary or inevitable.

Much like historical examples of such change, such as air transportation, the adoption of the internet, if one were to look back in time and plan them with the outcomes that have in fact, been achieved, they too would have seemed like pipe dreams.

This is perhaps the most pertinent difference in terms of perception. Most revolutions occur because a technology exists which enables the process, which takes place over 30 – 50 years. In the case of hydrogen transition, the vision has been set in part before the most efficient technologies have yet been developed to enable it. This, however, does not make it any less probable to occur than the laptop sitting in front of me as I write this article and certainly doesn’t make it any less necessary.

What is required to make the change is a commonality of vision and the knowledge that there is a need to start somewhere. Europe has a multi-billion-dollar hydrogen investment grant, the USA has followed suit, and almost every country in the world is providing incentives, Renewable Energy Credits, tax breaks, and other incentives to bridge the technology gap in terms of the economics of hydrogen production to make it profitable to invest in and operate.

New technologies, both emerging and currently deployed, are expected to dramatically reduce green hydrogen’s cost. It is at this point that blue hydrogen will start to be constrained, as sequestration of carbon carries an innate price that is not transferable to green hydrogen. As a result, green hydrogen will not be ‘forced into the world’ economy – it will naturally become cheaper than hydrocarbon extraction as time passes and will win vs. traditional energy sources based purely on the economic theory of supply and demand. It is not reasonable to look at a nascent industry like hydrogen generation and then compare it to the cost-effectiveness of hydrocarbons today.

The processes behind the extraction and exploitation of hydrocarbons have a 100-year history of technological advancement and cost-reduction behind them. This has not yet taken place on the renewable hydrogen timeline. It is however taking place and will continue to do so. As a result, lower-cost green hydrogen is a certainty.

Investors See the Potential:

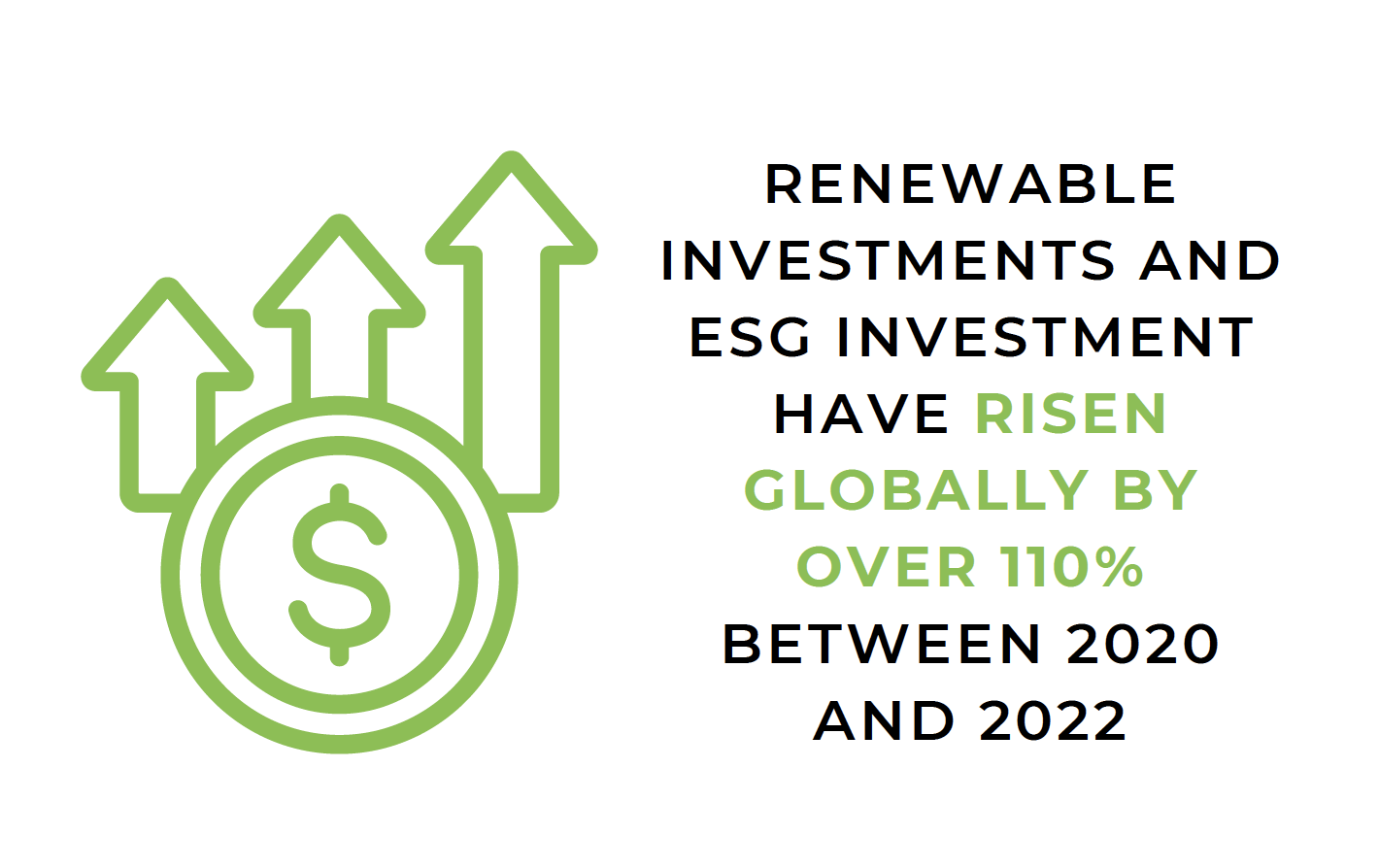

In general, renewable investments and ESG investment have risen globally by over 110% between 2020 and 2022, with some analysts indicating that there may be close to a trillion dollars in circulation at any given moment intended for ESG-based investment. Much of this is directed towards infrastructure and power generation, and a large slice of this sub-section is devoted to hydrogen and renewable ammonia development projects. While ESG may have become a bit of an overused term, with ‘sustainability’ goals of some entities bordering on the hilarious (reductions in office waste, which, although noble, would amount to about 0.1% of the environmental impacts our current energy economy has on the planet), investors, more often than not, have been savvy about what a true ESG play is and have been quick to spot greenwashing where it is apparent.

Given the timeline for wide scale renewables, and thus wide scale renewable hydrogen development, the hydrogen transition is not a threat to anyone currently working in the oil and gas industry, as by any measure, they will have retired (or close to it) by the time hydrogen has a significant impact on the energy economy. It is also little cause for concern for anyone investing in the industry for that matter – in fact, it’s been a benefit in so far as the rush to invest in hydrogen has cleared the field for those plucky funds still willing to invest in the oil and gas industry rendering it a buyer’s market. Simply put, the levels of investment entering renewable energy, although only currently 12% of the total invested capital in energy, represent about $60 billion in North America this year alone.

This all amounts to opportunity, not just for investors looking for high yields based on the volume of capital to be deployed on ESG-focused initiatives and through Green Funds over the next 20 years, leading to a future seller’s market for any current investments, but also employees and workers of all industries with transferable skillsets. Moreover, it is additive to, not subtractive from, the current oil and gas industry and will secure a future for natural gas production as an energy source through blue hydrogen, making sure that there is a long and prosperous future for the hydrocarbon industry, even in the face of the energy transition. A cynic may say that the insertion of blue hydrogen into the discussion was performed intentionally by large oil and gas entities purely to this end (to provide end-of-life value to their natural gas assets). Still, in practice, regardless of the motivation, it is the shortest and most sensible route to getting hydrogen into circulation while renewable energy sources grow as a percentage of grid supply.

The Hydrogen Transition is Inevitable:

Decarbonization may be one of the most significant challenges facing humanity. Our entire economy has been built on the back of a near limitless supply of cheap energy (historically hydrocarbons), which has enabled the industrialization and digitization of the human economy and reality. It is, however, a complex challenge.

The opponents to the hydrogen transition in general point to the fact that it may not be a ‘perfect’ solution, so as a result, anything imperfect (such as continuing to spew uncontrolled volumes of carbon dioxide into the atmosphere) should have its fair shake in a debate on the subject. This thinking is self-nullifying to a broad degree and should be disregarded. In fact, the reason some of these points were mentioned in this article was to point out that the author is very aware of the imperfections in the renewable space; however, that does not mean they are not the best practical hope that the human species has to lessen its impact on the environment and result in a more sustainable economy.

The basis for the inevitability of the hydrogen transition is based on two fundamental realities.

- The technology is being developed and launched every day that will make, in combination, the generation of green hydrogen, and renewable ammonia cost-effective and competitive with conventional energy (particularly now, where the oil and gas industry’s price fundamentals are pricing in their renewable competition in spades).

- Companies and investors are making it happen by investing 10s of billions of dollars in hydrogen infrastructure projects, generation facilities, storage facilities, and point-of-use applications. (Even Tesla has started to see the fundamental limits to electric vehicles that will likely be driven by the finite quantity of rare earth elements required to make the batteries and is looking at hydrogen fuel cells for their cars in the future).

These initial investments, from Hydrogen City in South Texas through to the significant developments on the East Coast and the ever-increasing surge of more efficient electrolysis technologies, will come to fruition and begin the production and transportation of renewable energy hydrogen over the next ten years. These initial investments in green hydrogen, although not ‘solving’ the problem alone, will drive a supply of low-cost green hydrogen, enabling point-of-use applications for that hydrogen. These, in turn, will reduce the amount of carbon dioxide.

These entities are not just investing in Green hydrogen because of social considerations (though many are visionary entities that are truly seeking to change the world for the better) but also because, through short-term grants and incentives, it is very profitable to do so. Models show strong returns and high long-term yields on what amount to, in practice, low-risk investments (the macro-environment is one in which hydrogen will happen, and these assets will have future flip value when developed, likely into an environment rich with investment capital).

These incentives will, in turn, be replaced by technologies that result in a naturally lower price for hydrogen. Anyone questioning whether that will, in fact, happen need look no further than the West region of the ERCOT market, where the abundance of solar and other renewables has rendered power costs so low that nothing can credibly compete. Thirty-five years ago, by contrast, solar and wind required those incentives to make any sense at all, but technology, as it turns out, is a match for almost anything when enough time and investment is put into it.

It’s Not Simple, but it’s Necessary:

While human beings, by our very nature, seek the ‘perfect’ solution, or the ‘simplest’ solution, or one that can be easily apprehended, the reality of our complex and interconnected world is that such solutions seldom exist, and any simplification is in a sense, an oversimplification. Renewables are not magical sources of energy without any environmental impact – but they are sources of energy with a significantly reduced environmental impact, which results in an ability to generate more energy from the resources available on our finite planet.

Hydrogen may not be cost-effective now, but that isn’t to say it won’t be. The challenges to adopting it may be generational and long-term, but that doesn’t make them impossible, as multiple other generational changes in the past have demonstrated. The industry is populated by the creative, the visionary, and the brave, who are willing to invest, and drive towards a decarbonized future. These entities and individuals do so while recognizing fully the complexity of the labyrinth they are navigating and the complete criticality of doing so to the future of the human species.